Investment Management

We can assist you in achieving your long-term financial goals through managing, monitoring, and rebalancing your investment portfolio.

We can help you:

Define your investment goals

Find the right balance of risk and return

Minimize costs

Diversify and manage your portfolio

Optimize your tax strategy

Keep things simple

How It Works

Step 1: Understand your current investment situation

We'll begin with a comprehensive overview of your investment portfolio to assess your current financial standing.

Next, you'll complete a risk tolerance questionnaire to determine appropriate investment options.

Finally, we'll conduct a thorough assessment of your overall financial health.

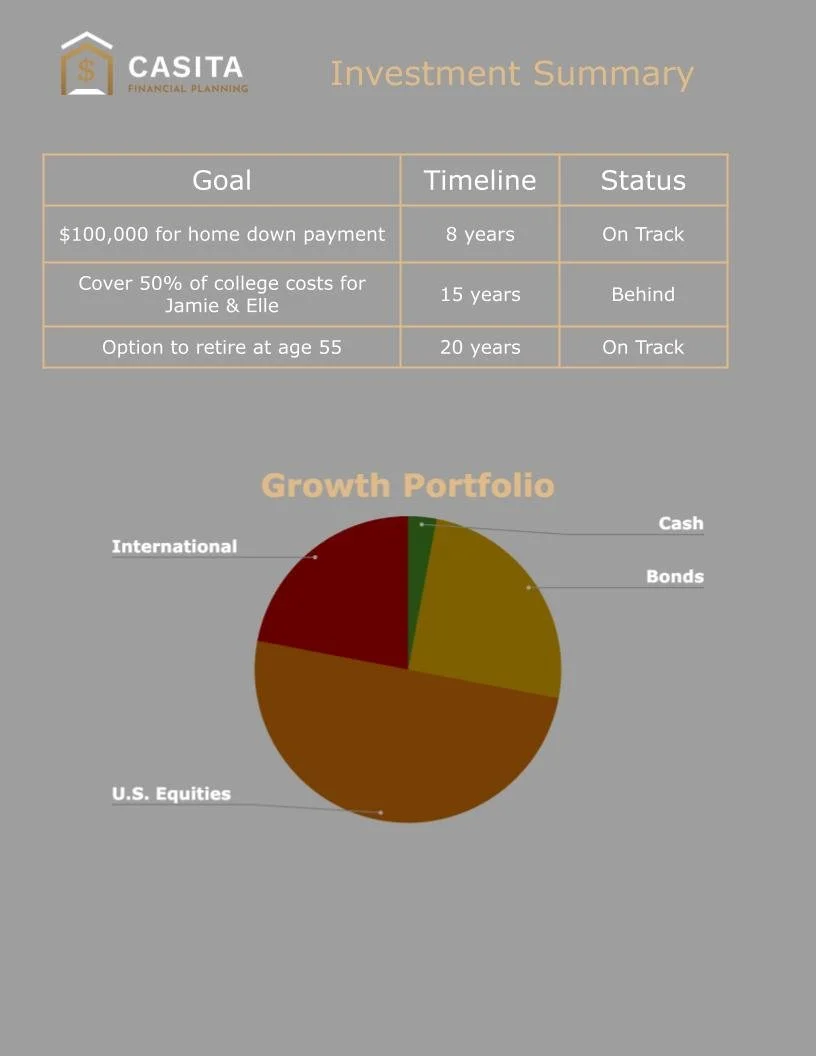

Step 2: Set clearly defined goals

Investing without goals lacks direction. We can help you identify your financial objectives to create a stable framework for your investment portfolio.

Understanding your goals allows us to determine your investment needs and risk tolerance.

Your goals also inform investment timelines and shape your specific investment allocation.

Step 3: Invest in an appropriate account and portfolio

We'll recommend appropriate investment accounts that align with your financial goals and tax situation. Retirement planning, for instance, might involve a mix of 401(k), IRA, and brokerage accounts, each with different funding and investment strategies.

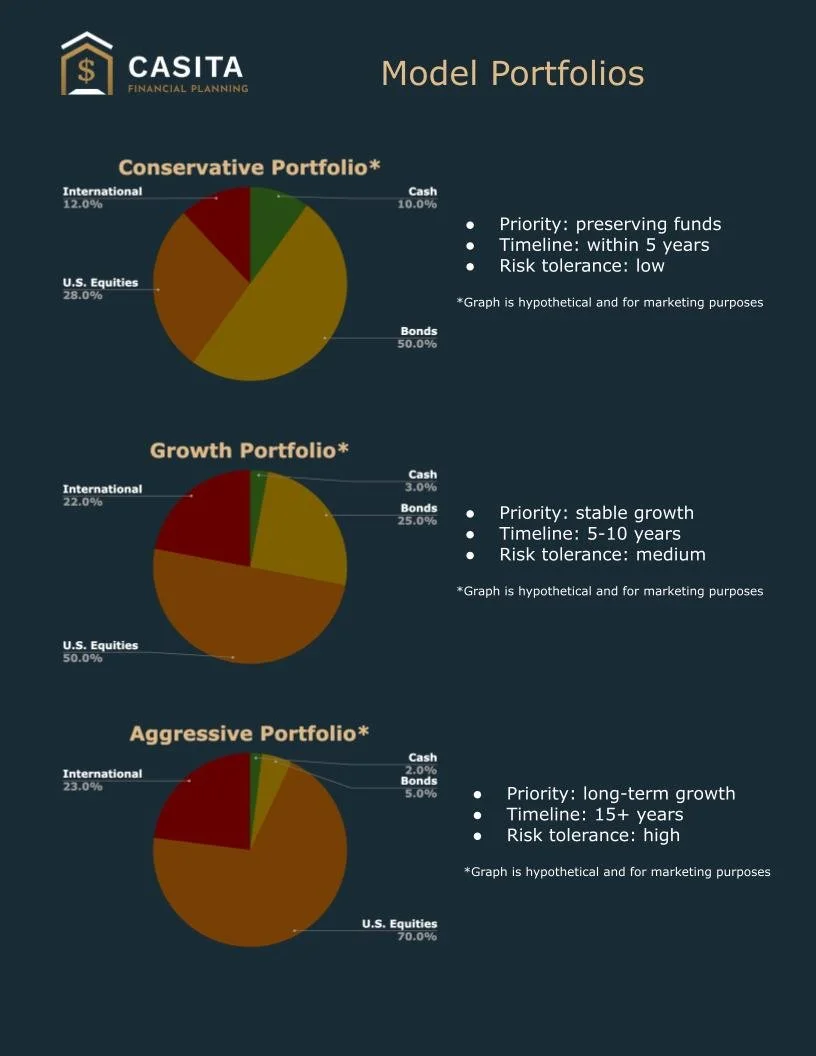

Based on your needs, we'll either assign you to a model portfolio or create a customized one that's tailored specifically for you.

Step 4: Think long-term

We'll keep an eye on your investments and make changes as needed, including systematic rebalancing to stay aligned with your goals.

We'll research and implement necessary changes as legislation evolves and new opportunities arise.

We encourage our clients to focus on long-term goals and try to ignore short-term market fluctuations.

Streamlined

For clients looking for a cost effective and simplified approach to investing.

Assets held at Betterment for Advisors

Annual advisory fee is 0.50% of assets under management.

Management Options

Custom

For clients with unique investments and require a tailored experience.

Assets held at Altruist. Fee is based on the following schedule:

$0 - $2,500,000, annual advisory fee is 0.90%

$2,500,001 - $10,000,000, annual advisory fee is 0.75%

> $10,000,000, annual advisory fee is 0.65%

Ready to get started?

Schedule your free consultation so we can begin building your financial future together.